Many eCommerce businesses are now opting for flexible payment solutions like Buy Now Pay Later, by understanding customers’ needs and demands. In the current era of the digital world, a robust strategy for payment solutions is required for retaining customers and long term growth..

Talking about payments, 48% customers choose to shop from the online store that provides multiple payment methods, along with that the other extra costs is the primary reason behind the abandoned carts. So it’s clear that a flexible payment solution can decrease abandonment and improve your store’s sales.

There is one such flexible and customer-friendly payment solution, Buy Now Pay Later (BNPL).

Buy now pay later is a great payment choice to have in your store. It can effectively integrate with WooCommerce.

It is prevailing, giving your customers a way to pay less upfront for your products when they have a tight budget and giving you, the seller, increased sales.

This article will guide you through all you need to know about the Buy now pay later payment method, and how to enable Buy now pay later in

WooCommerce.

Summary

Buy now pay later (BNPL) gives customers the freedom to buy products without paying the full amount upfront, making shopping easier and more affordable, especially for bigger purchases.

For store owners, it means better chances of increasing sales, boosting average order value, reducing cart abandonment, and building stronger customer relationships.

This flexible payment option has quickly become a smart move for many eCommerce businesses looking to stay competitive.

Whether you use WooCommerce with the Wallet System plugin or go with other BNPL providers like Sezzle, PayPal Credit, Klarna and WooCommerce Pay Later plugin, offering this option can make a real difference in how customers shop and how your business grows.

What is Buy Now Pay Later? And Why Do You Need It?

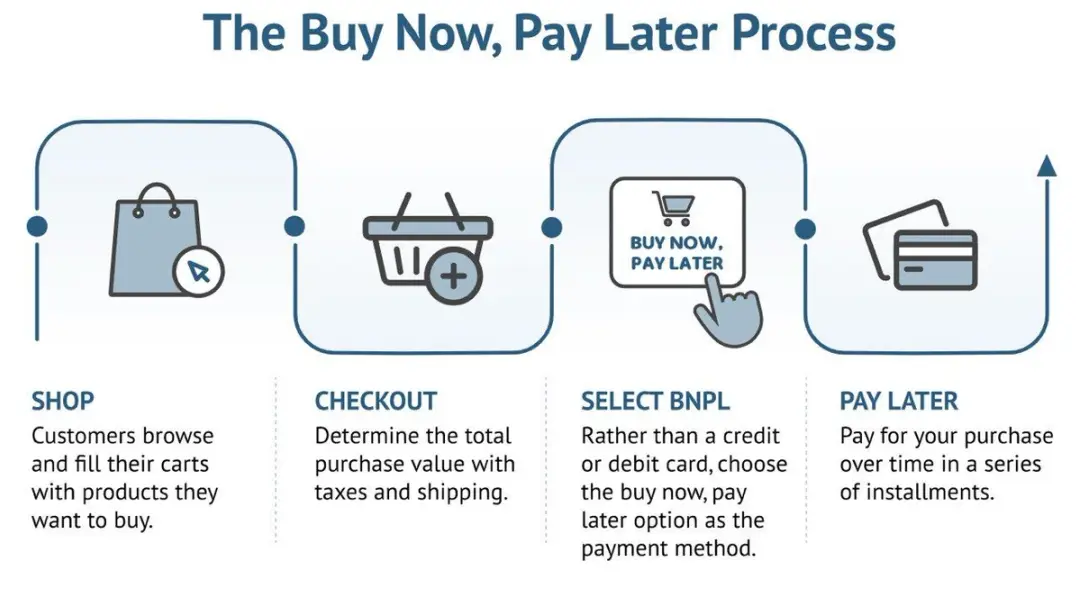

Buy now pay later works much like a consumer credit card but without the typical restrictions. It allows customers to pay a small upfront amount when purchasing a product and settle the remaining balance in installments, either monthly or as defined by the store.

[Source: Clever Notes]

In recent years, Buy Now Pay Later has gained strong popularity in the WooCommerce ecosystem. According to global payment processor FIS, it’s now among the fastest-growing payment methods in eCommerce worldwide.

Let’s dive into everything you need to know about offering Buy now pay later for your online store.

How Does Buy Now Pay Later Work?

Buy Now Pay Later method works when an agreement between both parties is made on the condition that both the principal and interest amount will be paid by the customer.

This whole process can be a bit complex if managed directly by the store owners, but nowadays in the market, there are a lot of options available for Buy Now Pay Later that merchants can utilize to ease the workflow.

These third-party solutions do soft checks on the users so that they will give loan to the individual who don’t run away and pay back. They do all the heavy verification work while you can focus on managing and growing your businesss….

How Buy Now Pay Later Benefits eCommerce Stores

There are multiple benefits of Buy Now Pay Later, some of which are listed below

1. Increase Purchases

BNPL helps boost sales by making it easier for customers to buy products, even if they don’t have enough money at the moment. Instead of paying the full amount upfront, customers can pay over time.

This makes shopping feel more affordable, especially for higher-priced products. As a result, more customers end up completing their purchases, leading to a direct increase in sales for your store.

2. Improve Average Order Value (AOV)

When Customers have the option to split payments, they often spend more than they originally planned. This gives store owners the perfect chance to offer upsells or bundle deals.

For example, a customer buying a phone might also add a case or earphones if they can pay over time. BNPL encourages customers to say “yes” to extra offers, which raises the average amount spent per order and helps increase overall profits.

Increase Average Order Value With Our Upselling Combo

3. Reduce Cart Abandonment

Many online shoppers add products to their cart but leave without buying because the total amount feels too high. BNPL helps reduce this by offering an easy, budget-friendly payment option at checkout.

However, it’s important not to push too many offers at once, overwhelming customers with upsells or greedy tactics can backfire. The sweet spot is to offer BNPL naturally, as a helpful option, so customers feel supported, not pressured, leading to fewer abandoned carts.

4. Competitive Advantage

In today’s growing market, customers expect flexible payment options, and many stores already offer them. When you utilize BNPL on your website, you give your store a competitive advantage. Customers are more likely to buy from a store that offers BNPL than the one that does not.

It highlights that your business understands the customer needs and is keeping up with modern shopping trends, helping you stand out from your competitors.

5. Increase Customer Loyalty

When customers have a smooth buying experience with flexible payments, they’re more likely to return. You can take this a step further by connecting your BNPL option with a loyalty rewards program.

Every time a customer shops using BNPL, they can earn points or rewards for future purchases. This not only builds trust but also gives them a reason to come back, helping you create long-lasting customer relationships.

How To Implement Buy Now Pay Later In Your eCommerce Store

There are multiple ways to integrate Buy Now, Pay Later (BNPL) into your eCommerce store, but the easiest and most common method is by using a third-party plugin, especially if your store runs on WooCommerce.

Since WooCommerce powers nearly 39% of the global eCommerce market, we’ll assume you’re using it too.

So, let’s explore how you can set up a BNPL option on your WooCommerce store using a plugin.

BNPL Using Wallet System For Woocommerce By WP Swings

Wallet System for WooCommerce Pro is a digital wallet plugin that also supports a Buy Now Pay Later (BNPL) feature.

If a customer’s order amount is higher than their wallet balance, they can use BNPL to pay the remaining amount later. As a store owner,

you can even charge interest on the pending amount.

Besides BNPL, the plugin offers many useful features like:

- Wallet transactions via QR Code

- Restricting wallet activities for specific users

- Charging fees on wallet transfers and withdrawals

- Sending SMS alerts to customers

- Credit and Debit Amount manually

- Provide Cashback on Wallet Recharge

- Credit wallet on favorable actions and referrals

- And much more!

Let’s see how you can set up the Buy Now Pay Later feature.

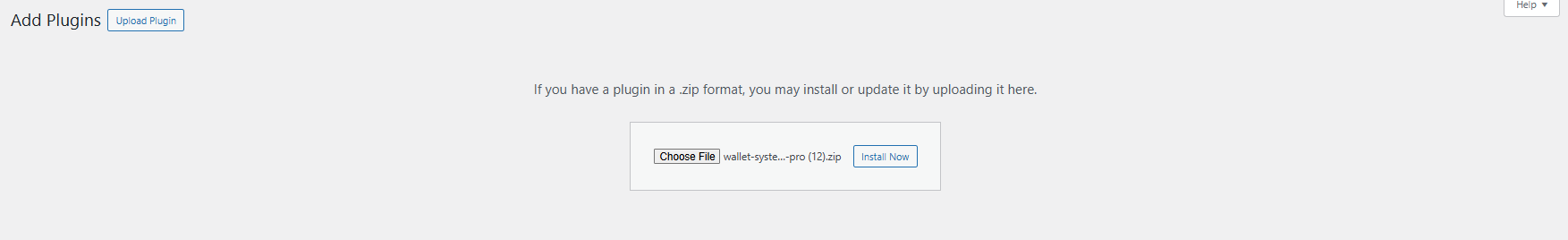

Step 1: Add WooCommerce Plugin

Firstly, go to your WordPress plugin directory and download the Wallet system plugin.

Advanced features for the Buy Now Pay Later are available on the pro version of the wallet plugin, which you can purchase from the WP Swings official website.

-

- Go to your WordPress Dashboard, then to Plugins > Add New.

- Click on the Upload Plugin button and go to Choose File to pick the file you downloaded.

- Click Install Now and then Activate.

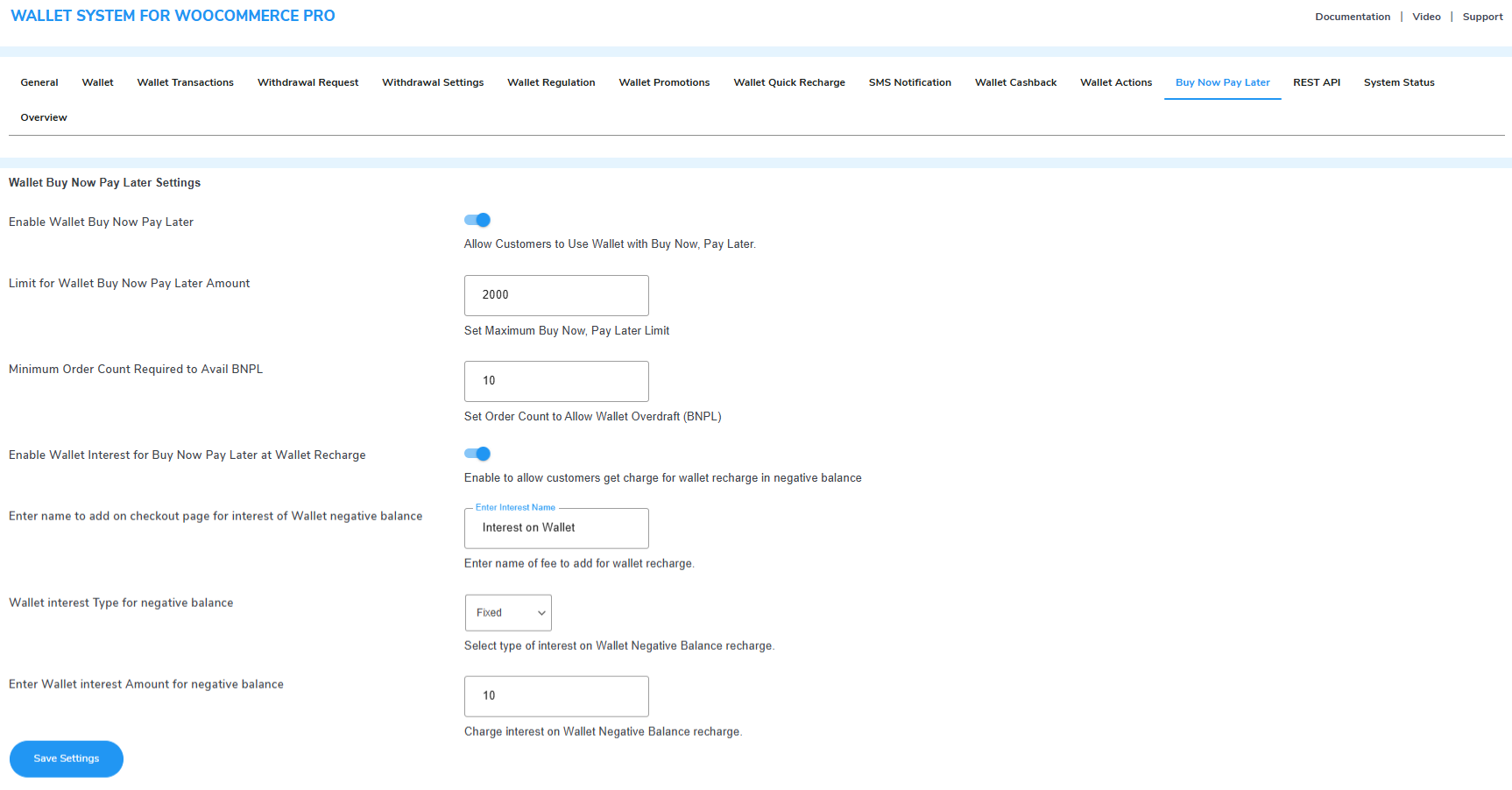

Step 2: Navigate to the BNPL Tab

Once you have activated the plugin and enabled it from the general settings, navigate to the BNPL tab,

You get several flexible options to set up the Buy Now Pay Later (BNPL) feature based on your store’s needs.

- Enable the BNPL option from the settings.

- Set a minimum purchase amount that customers must complete before they can access BNPL. This ensures only eligible customers can use it.

- Define the minimum and maximum BNPL limit for each user, controlling how much they can borrow.

- You can also choose to charge interest, either a fixed amount or a percentage of the BNPL order value.

Once you configure these options, BNPL will be active on your store.

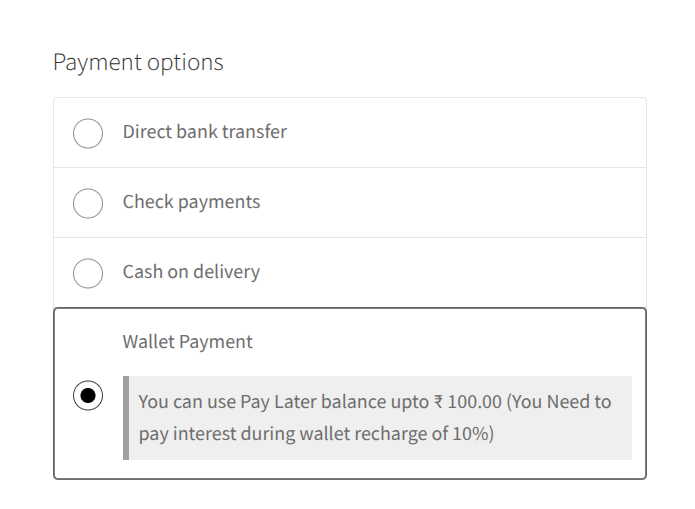

Step 3: Test If Everything is Working Fine!

Now BNPL is active on your store, it’s time to test if everything is working fine, to provide a smooth experience to your users. To do this, you can log in as a guest user, but before that, credit some amount from the backend to your demo user’s account, then test the functionality as per the scenario below

How it works: If a customer’s wallet balance is less than the order amount, they’ll see a BNPL option at checkout. They can pay whatever amount they currently have in their wallet, and the rest will be covered by BNPL. You can then collect the remaining amount later when they recharge their wallet.

Alternative Payment Options To Uplift Revenue

Now that we have a better knowledge of what Buy now pay later and how it works, let us see some of the popular alternative payment options that can help you to uplift your business:

1. WP Simple Pay

WP Simple Pay is a splendid plugin to enable Buy now pay later payments. This plugin offers you a 14-day money-back guarantee. With WP Simple Pay, you can complete payment forms without putting up a confusing checkout procedure.

WP Simple Pay’s free version does not limit the usage of the plugin, but if you want to use more additional features then upgrade to the paid version.

By using this plugin, you can make simple payment forms without dealing with complicated payment APIs. There exist many ways to customize your payment forms, like by operating a drag-and-drop editor or simply using Stripe’s checkout payment pages.

Plus, it is designed to customize your forms so you can have them shortly in minutes.

2. Klarna

Klarna buy now pay later is a flexible solution that allows you to add the Klarna payment methods of your preference to your checkout. There is no annual fee charged for klarna. It gives three payment plans, together with the pay-in-four model, it even offers a Pay-in-30 model and a monthly financing alternative.

You can simply download the buy now pay later Klarna app and start shopping online through Klarna, and if you skip one of your four payments, you will be levied a late fee of $7.

Despite this, if you are on a “No Interest If Paid In Full” plan and you could not make a payment, then you will be levied with deferred interest on the complete purchase at a rate of 19.99% APR.

3. PayPal Credit

PayPal Credit was previously named “Bill Me Later”. It is a free plugin that forms a quick solution for accepting payments. It offers installment plans on purchases of $99 or more if paid in full within six months then no interest will be charged.

PayPal Credit provides users a path to expand the payment duration of a particular purchase via a line of credit issued through Synchrony Bank, and it will be upon the user’s creditworthiness.

If in case you do not pay your full balance, you will have to pay deferred interest on the total purchase at a rate of 23.99% variable APR.

4. Sezzle

Sezzle is a simple payment solution that provides interest-free installment plans and it is free to use. It splits the total price of your purchase into smaller payments spread over a minimum of six weeks. There is no hard credit check by Sezzle.

It will check your credit which will not impact your credit score, and they utilize these details to approve you for Sezzle, confirm your originality, and help lessen risk.

You will have to pay 25% of the entire amount purchased to Sezzle if you shop via a vendor that offers Sezzle, and the remaining payment will be divided into three further installments expected two weeks apart.

If you make payments on time, then no extra fees or interest will be charged, and if you skip a payment, you will be charged a late fee.

5. Afterpay

Afterpay is another digital payment platform that offers you a short-term installment plan through its app and it is free to use. You can download the app to make a purchase by using a virtual consumer credit card and then pay the first of four payments, and the leftovers are spread over six weeks.

Afterpay will restrict the limit on how much credit they will extend to the user so that you would not overextend yourself. Besides, if you do not make your payments on time then your account will be paused, and you might be charged late fees that can be nearly 25% of the purchase

Conclusion

Delivering flexible payment solutions is the foremost priority of many eCommerce businesses. With the Buy Now Pay Later in WooCommerce, your customers can immediately purchase products and pay over time in weekly or monthly installments or even when they recharge their wallet. Presenting this option at the checkout makes the final purchase decision easier for your customers.

Thus, if you want to deliver the most pleasing shopping experience to your customers via flexible pricing, improve the average order value, increase revenue, and lessen payment fraud.

In that matter, look into the BNPL solutions noted above and select an option that fits your budget and exact necessities.