In today’s digital world, secure online payments are more important than ever for eCommerce businesses. Customers expect a smooth and safe shopping experience, and without proper security, you could risk losing their trust – not to mention your business’s reputation.

When your online store isn’t equipped to handle secure online payments, it opens the door to fraud, data breaches, and other cyber threats. As an eCommerce store owner, it’s important to understand how to protect customer payment information and ensure secure online payments every step of the way.

In this article, we’ll explore common payment methods and how to keep them secure, so you can protect your customers and your business

Table of Contents

Understanding Secure Online Payments

When it comes to running an eCommerce store, understanding how to secure online payments is vital for protecting both businesses and customers. Payment security refers to the practices and technologies that secure information during transactions.

Without strong payment security measures, your store is at risk of fraud, data breaches, and cyber attacks that could compromise sensitive information. Some of the common threats include phishing and unauthorized access to payment details. Some of the common threats include phishing and unauthorized access to payment details — risks that can often be mitigated by using a domain analyzer to check for email security gaps and protect your brand identity in customer communications

As an online store owner, it’s your responsibility to be aware of these risks and implement the right strategies to secure your online. In this context, working with a reliable merchant of record can help ensure that transactions are processed safely and compliance requirements are met. Further in this blog, we will talk about different payment methods that most of eCommerce store owners use and how to secure them so stay tuned!

6 Common Payment Methods and How to Secure Them

Here are 6 payment methods commonly used by eCommerce stores and how to secure them

1. Credit and Debit Cards

Credit and debit cards are among the most popular payment methods for online shopping, but they come with a range of security threats. Data breaches can expose sensitive card information, skimming can steal card details during transactions, and phishing attacks can trick customers into giving away their information. A phishing simulation can help users learn how to recognize and avoid these scams.

To protect your eCommerce store from these threats, you need to follow several key security measures:

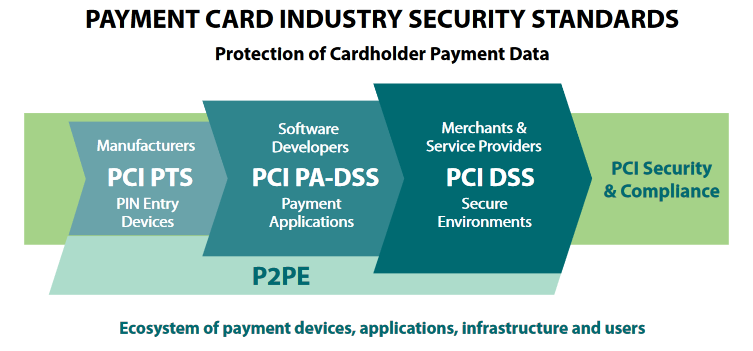

- PCI DSS Compliance: Ensure your store meets the Payment Card Industry Data Security Standards (PCI DSS). This includes securing card data, limiting access to it, and regularly testing to secure payments systems.

- SSL Encryption: Use SSL certificates to encrypt sensitive data like card numbers during transactions. This keeps payment details private and secure from hackers.

- Tokenization: Instead of storing card numbers, use tokenization to replace sensitive card details with random tokens. This reduces the risk of data exposure, even if a breach occurs.

Implementing these security measures can reduce the risk of data breaches and you can protect your customers’ credit and debit card information and provide a more secure online payments experience.

2. Digital Wallets (e.g., PayPal, Apple Pay, Google Pay)

Digital wallets have become a popular choice for online payments due to their convenience, but they also come with security challenges. Partnering with expert banking software development services can help you build payment systems that adhere to the highest security and regulatory standards. Key threats include account hijacking, where attackers gain unauthorized access to user accounts, and phishing attacks, which trick users into revealing their login credentials.

To enhance the security of transactions made through digital wallets and ensure secure online payments, consider the following measures:

- Enable Two-Factor Authentication (2FA): Encourage customers to activate 2FA on their digital wallet accounts. This adds an extra layer of protection by requiring a second form of verification in addition to the password.

- Monitor for Suspicious Transactions: Regularly check for unusual activity to secure payment processing systems. Implement alerts for high-value or rapid transactions that seem out of the ordinary.

- Ensure Secure API Integrations: Make sure that any APIs used for digital wallet integrations are secure and up-to-date. This minimizes the risk of data leaks during transactions.

A Plus Point Would be implementing QR codes as a security measure. QR codes can facilitate secure payments by allowing customers to complete transactions quickly and safely without entering sensitive information. Platforms like Amazon Pay for Business, rated 4.5/5 on G2, are particularly valued for trusted, frictionless checkouts. Reviewers note that its built-in fraud protection and integration with Amazon accounts give shoppers confidence and reduce cart abandonment

Secure Digital Wallet Payment With QR Codes

3. Bank Transfers (ACH Payments)

Bank transfers, particularly Automated Clearing House (ACH) payments, are a reliable method for online transactions, but they come with their own set of security risks. Key threats include account number theft, where hackers gain access to sensitive banking information, phishing attacks that trick users into revealing their credentials, and man-in-the-middle attacks, where fraudsters intercept and alter communication between the buyer and seller.

To enhance the security of bank transfers, consider implementing the following measures:

- Encrypt Bank Transfer Data: Use strong encryption protocols to protect sensitive bank information during transfers. This ensures that even if data is intercepted, it cannot be easily accessed or used by unauthorized parties.

- Use Secure Bank Authentication Protocols: Implement secure authentication methods that require users to verify their identity before completing a transaction. This might include two-factor authentication or secure tokens to enhance protection against unauthorized access.

- Implement Fraud Detection and Alerts: Set up systems to monitor transactions for unusual activity, such as large or unexpected transfers. Alerts can notify you and your customers of any suspicious behavior, allowing for quick action to prevent potential fraud.

Following these security practices keeps you one step ahead, reducing the risk associated with bank transfers and providing a secure online payments option to your customers.

4. Buy Now, Pay Later (BNPL) Services (e.g., Afterpay, Klarna)

If your e-commerce store provides the option to buy now and pay later, here are ways you can secure it.

Buy Now, Pay Later (BNPL) services have gained popularity for their convenience, allowing customers to make purchases and pay for them in installments. However, these services also come with significant security threats, including identity theft, where personal information is stolen to create fraudulent accounts, and fraud via credit-based models, which can exploit loopholes in the system.

To enhance the security of BNPL transactions, consider the following measures:

- Use BNPL Providers with Identity Verification: Choose BNPL services that use robust identity verification processes. This ensures that only legitimate customers can access financing options, reducing the risk of fraud.

- Securely Integrate BNPL APIs: Ensure that any APIs used to integrate BNPL services are secure and follow best practices for data protection. Regularly update and test these integrations to safeguard against vulnerabilities.

- Monitor Credit Behavior and Transaction Patterns: Keep an eye on customer credit behavior and transaction patterns. You can implement systems that flag unusual activities or spending patterns that may indicate fraudulent use of BNPL services, or if your customer base is not very big, you can manually monitor these activities.

5. Cryptocurrency (e.g., Bitcoin, Ethereum)

Most people think that crypto payments are secure, and in some ways it is. But everything has a loophole

As Famous computer researcher, Dan Kaminsky said

[Source: CoinDesk]

“It is a fairly open secret that almost all systems can be hacked, somehow.”

Cryptocurrency has become an increasingly popular payment method due to its decentralized nature and potential for lower transaction fees. However, it also presents unique security challenges, including hacking, where malicious actors attempt to steal digital assets, and wallet breaches, which can lead to the loss of funds, and irreversible transactions, making recovery of lost funds nearly impossible. For users looking for convenient ways to acquire digital currency, options like buy USDT with PayPal are becoming more accessible and widely used. If you’re transacting from the United States, choosing the best US crypto exchange can also enhance your experience by ensuring regulatory compliance, platform security, and ease of fiat-to-crypto conversions

To enhance the security of crypto transactions, consider the following measures:

- Store Crypto in Cold Wallets: Keep your digital assets in cold wallets. Cold wallets, or cold storage, are offline cryptocurrency wallets that enhance security by not being connected to the internet. They come in two main types: hardware wallets (physical devices) and paper wallets (printed keys), making them ideal for long-term storage. This reduces the risk of hacking and unauthorized access compared to hot wallets, which are connected to the internet. Ensuring your crypto operations comply with regulations by obtaining a Vara license can further strengthen trust and legal security in your transactions

- Use Secure Payment Gateways: Choose reliable and secure crypto payment processors, such as BitPay or Coinbase Commerce, for your transactions. These platforms have robust security measures in place to protect both merchants and customers.

- Implement Multi-Signature Authentication: For larger transactions, use multi-signature authentication, which requires multiple approvals before a transaction is completed. This adds an extra layer of security, ensuring that no single person can authorize significant transactions without consensus.

6. Prepaid Cards and Gift Cards

Prepaid cards and gift cards are popular payment methods that offer convenience and flexibility.

Gift card fraud particularly happens through stolen or duplicated cards. If a card is compromised, it can lead to unauthorized purchases, putting both customers and merchants at risk.

To enhance the security of prepaid and gift cards, consider implementing the following measures:

- Activate Prepaid/Gift Cards Only After Purchase: Ensure that cards are activated only when purchased. This prevents thieves from accessing card details before the card is in the hands of a legitimate customer.

- Set Spending Limits and Monitor Card Usage: Establish spending limits on prepaid and gift cards to minimize potential losses in case of fraud. Regularly monitor card usage for any suspicious transactions, allowing for prompt action if needed.

- Use PIN Protection for Card Transactions: Require a personal identification number (PIN) for all transactions made with prepaid and gift cards. This adds an extra layer of security, ensuring that only the cardholder can use the card.

Gift Cards For WooCommerce Pro

Consider using our Gift Cards for WooCommerce plugin to manage your gift card offerings effectively. This plugin not only allows you to create and sell gift cards easily but also incorporates various security features to help protect against fraud.

8 Best Practices To Secure Online Payments

Here are some best practices for secure online transactions & payments

1. Using Payment Tokenization

Tokenization is a method of securing sensitive data. In this process, algorithmically generated numbers and letters replace the sensitive data, making it unrecognizable.

It allows secure online payment & other data transfers and protects your online store.

2. Enable Two-factor Authentication

Two-step verification or two-factor authentication is a protection method in which a user enters their password and then authenticates themselves using a secondary method like biometrics, OTP, etc.

This is widely used to secure online payments by all major payment providers, including national and local banks.

You can easily set up two-factor authentication on your WooCommerce website.

3. Adhere to PCI Compliance Guidelines

PCI compliance guidelines consist of the best practices to protect your payment systems, holder data, access control, etc.

You must meet the PCI compliance requirements, often built into modern banking software, to secure online payments on your online store. You can read FAQs regarding these guidelines here

4. Setting Strong Passwords

People have a habit of simplifying tasks they should be doing with painstaking detail. Setting up a password has a direct result in securing online payments on a website but it is not followed seriously.

So, please avoid dedicating your passwords to your failed relationships, birthdates, or pets. Make a complex password with various alphanumeric and special characters. And use a password manager if your memory is not sharp enough. It is the most basic way to ensure the security of online payments. Maintaining strong email deliverability is also key. Techniques like SPF Flattening help keep your records optimized so legitimate payment notifications always reach customers without interruption

5. Getting the SSL/TSL Certificate

SSL and TSL certificates are essential for all online website security. It is reflected in the address bar with a lock icon. You can easily confirm whether your website is protected or not. So, it helps earn users’ trust.

The main function of these certificates is to secure online payments and protect user data, verify website ownership, and prevent hackers from duplicating your website.

Most hosting providers give you an SSL certificate as you create a website using their services. For example, Bluehost, GoDaddy, etc. It is wise to try alternate options like different SSL providers who offer SSL certs at a nominal price. A site owner with different subdomains can secure payments online with reputed SSL brands like Comodo SSL, and RapidSSL wildcard certificate

6. Regularly Update Your WooCommerce Plugins

Woocommerce is one of the most popular ecommerce plugin, anf if you are and online store owner then there is a lot of chances that you might be using this plugin.

One of the most crucial practices for store owners can be regularly updating their woocommerce plugins, keeping your plugins up to date ensures that you have the latest updates and security patches, which protects your store from vulnerabilities that cyber criminals could exploit

7. Define User Roles

Sometimes the castles are sieged from within. That’s why it is important to carefully give access to individuals working in the backend of your WooCommerce website.

Only give the necessary permissions to individuals and keep access control to yourself. In case of a security breach from an unsuspecting user, you can make sure hackers don’t get their hands on any sensitive information.

8. Train Your Resources

It is crucial to hire trained staff and to provide training to existing resources in proper security and data protection measures. To secure online payments, they must be aware of the entire process and its vulnerabilities.

Bottomline: Prevention is better than cure.

These were the major ways to secure payments online. For more information, you can read the WooCommerce fraud prevention guide

On A Final Note

And that’s a wrap-up for this article, secure online payments is essential, and in this blog we have talked about the most common payments methods and how to secure online payment, we have also talked about the best practices to secure your online payments.

You can implement effective measures to safeguard sensitive information.

Remember, prioritizing payment security not only protects your customers but also enhances your store’s reputation and fosters long-term loyalty

Let me know your thoughts in the comment section below

And hey, check out our blogs if you want to learn more about best eCommerce practices.